With the Paper Airplane Example – Why Backtesting Is Important

Make the paper plane. Before you release it to the wind, first test it inside, make any folds, then try it once more. Backtesting with options trading is exactly like the previous method. It allows you to test your trading plan on previous market data before you actually use money. This will help you:

- Make your plan for trading more effective

- Feel confident and more secure

- Check to see if your plan could work with more trades

What Is Options Backtesting?

Backtesting is the process of using previous price data to test your trading’s rules. This answer is:

>> “If I had used this trading plan last year, what would have happened?”

Instead of making a guess, you’ll get confirmation that your plan is successful or needs to be improved.

Learn the Basics of Options

Options are agreements that are different from other contracts. They offer you the “choice to purchase, but they do not impose the obligation to purchase or sell something for an agreed price.

- Call Option – If you think that it will cost you moreto.

- Put Option – Put an option where you believe the price will fallto.

- Expiry – Based on weekdays and on a monthly basis.

Options can help you earn more money However, they can also be dangerous. It’s why it is crucial.

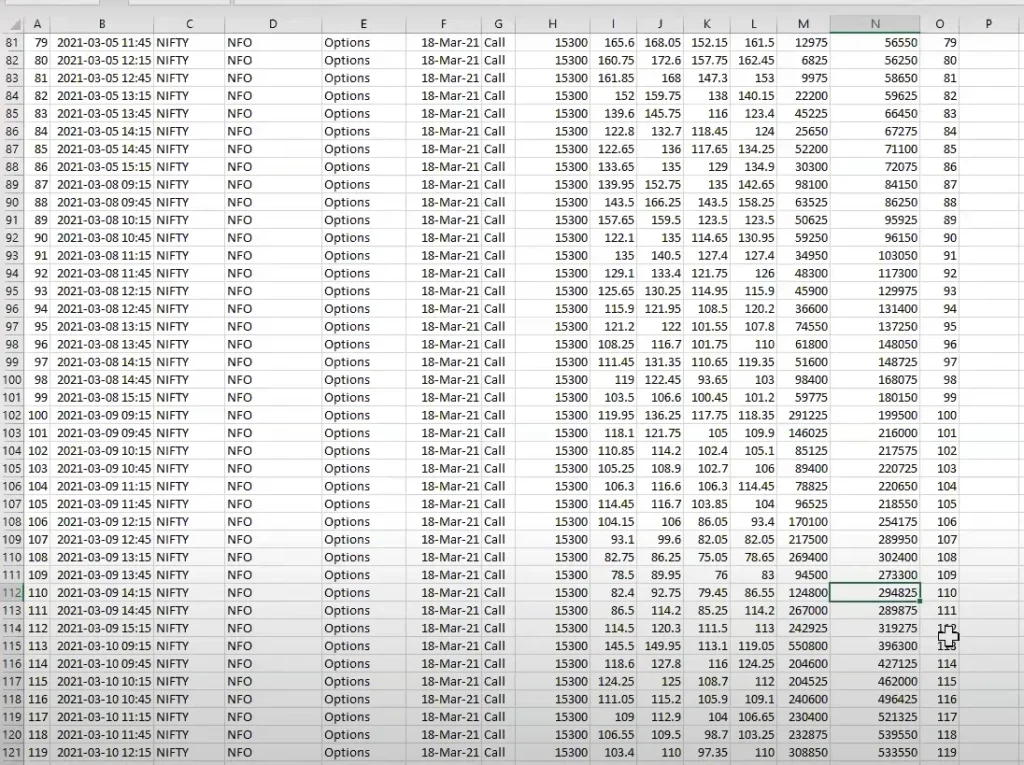

Collect Good Data

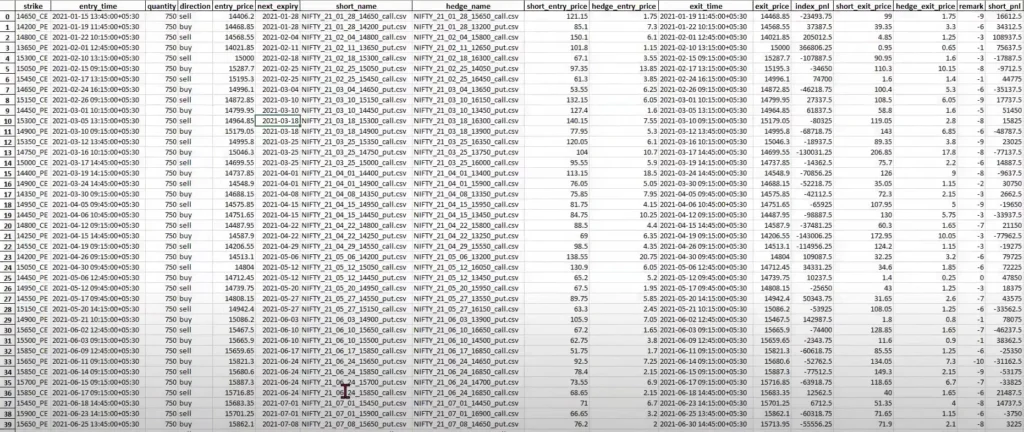

Here’s an example of real NIFTY options data (15300 Call February 2021). The data contains times and volumes, and strike prices as well as price levels (open high and low), as well as closing). This is the data that your test requires.

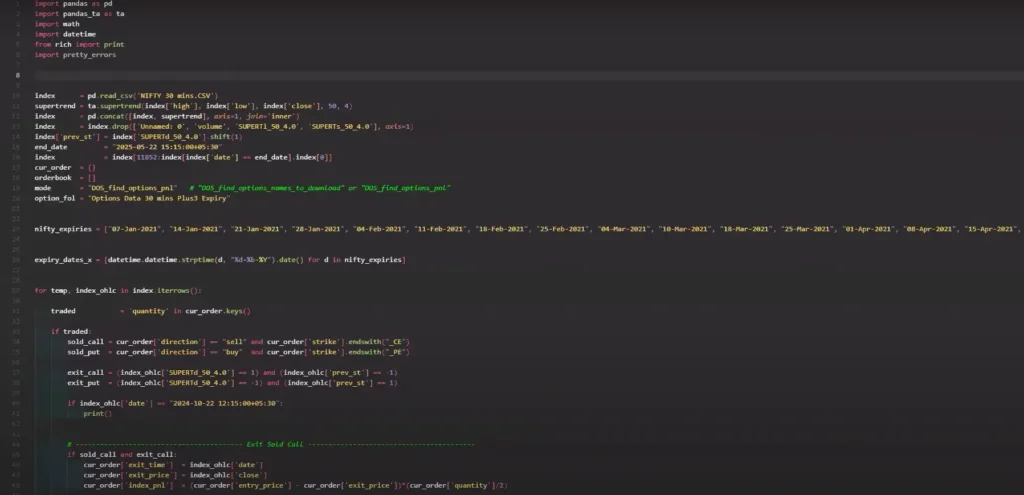

Make Your Backtest Program

You can utilize Python (a programming language for computers) to interpret the data and verify your plan. It is also possible to add Supertrend or other tools to look for patterns. Libraries such as pandas”pandas_ta” and “datetimecan make this simple.

Learn by Watching

Video watching can help make learning easier. Look up a quick explanation.

Try Your First Backtest

1. Decide on Your Strategy – Example: Purchase NIFTY Calls when the average of 5 days* exceeds the 20-day average.

2. Get Past Data – Make sure to use clean, high-quality data, such as that of the NIFTY example.

3. Run the Test – Use your code or platform such as QuantConnect or Backtrader.

4. Check the Results:

- PNL Rate – How many trades generated money

- Risk Ratio – How much you earned compared to the amount you risked

- Max Drawdown – most significant decrease in value

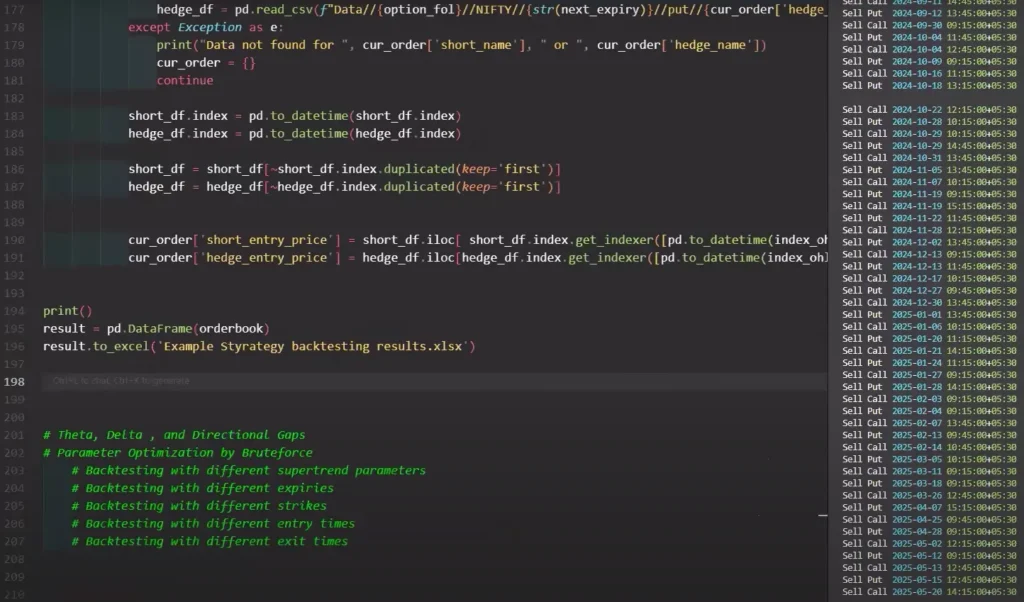

#Save Results to Excel via Python

Save Results to Excel via Python

The test result can be stored as Excel files which anyone can access and examine them:

Even non-coders can open, filter and evaluate the performance of their Excel spreadsheets.

Example Backtest Results :-

This give you a better result & evidence-backed performance.

Test in Different Ways

- Consider various dates and strike rates

- Check the different conditions that affect the crossing.

- Use other indexes such as MIDCPNIFTY or BANKNIFTY.

- Try bigger sizes of trade to determine if it performs well.

If your plan is still working following these test, then it’s more secure to implement it in real-time trading.

Make It Fun

Backtesting is like an experiment in science. Try, fix then try again.

Small wins are celebrated as your strategy improves.

Be patient, since markets change constantly and your strategy must alter as well in line with changes in the market.

Final Message

Backtesting doesn’t need to be boring. It’s your”safe place” to test your trading ideas. With a solid foundation of data, easy testing, and curiosity you are able to:

- Make trading plans that actually perform

- You can be confident about using these

- Transform your trading dreams into reality, ready to use the strategies you have chosen

If you’re new to trading in data-driven circumstances, you can open Python program and begin your backtesting now!