The National Stock Exchange (NSE) has announced an update that’s great news for traders — especially for those who trade in index derivatives like Nifty and Bank Nifty.

By reducing lot sizes, NSE has made trading simpler, more accessible, and less capital-intensive.

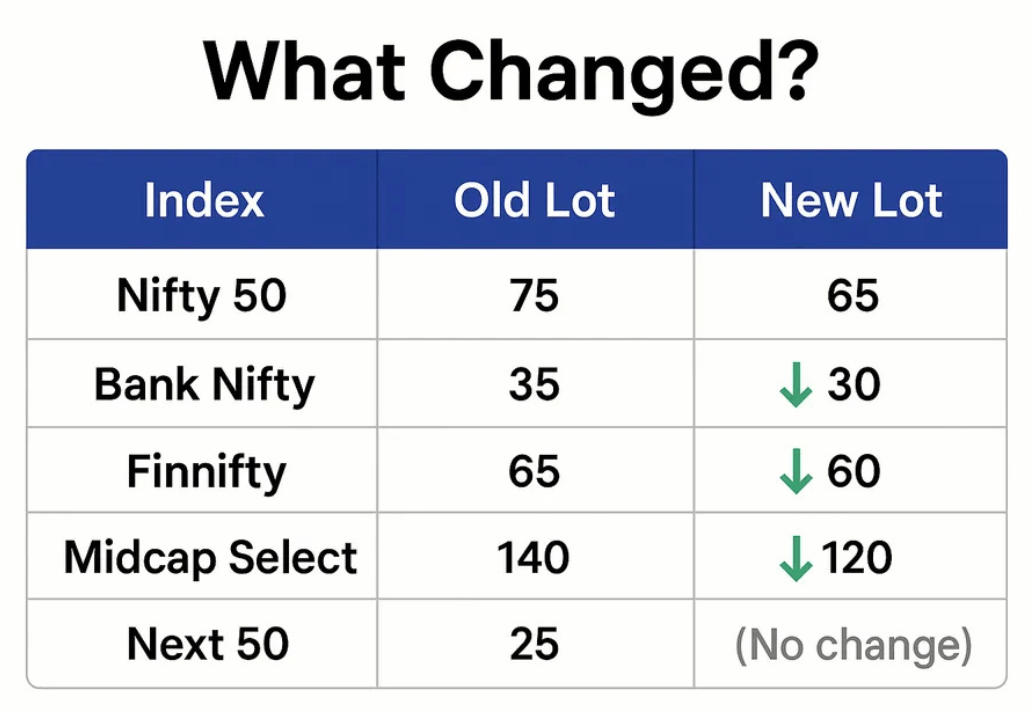

What Exactly Has Changed?

NSE has officially reduced the lot sizes for some of its most popular index derivative contracts.

Here’s the updated list

- Nifty 50: from 75 → 65

- Nifty Bank: from 35 → 30

- Finnifty (Financial Services): from 65 → 60

- Nifty Midcap Select: from 140 → 120

- Nifty Next 50: remains 25

This means traders will now need less margin money to take positions — making it easier for more people to participate.

Why Did NSE Make This Change?

As index prices continue to rise, the overall contract value of each derivative also goes up.

To keep things affordable for all traders, NSE decided to reduce the lot sizes so that the total contract value stays around ₹15 lakh.

This helps in maintaining balance between risk, capital, and participation — a win-win for both retail and institutional traders.

Smaller lot size → Lower contract value → Less margin money needed → Easier for more people to tradeWhen Will the New Lot Sizes Apply?

The new lot sizes will come into effect from the December 30, 2025 expiry.

Here’s how it’ll work:

- Until December 30, 2025, all existing contracts (weekly, monthly, quarterly, etc.) will continue with old lot sizes.

- Starting from the evening of December 30, 2025, all new contracts will automatically switch to new lot sizes.

So, make sure to double-check your lot size before placing any trade during the transition period (especially between October and December 2025).

Let’s Understand with an Example

Suppose Nifty is trading at 24,800.

- Old lot size (75 units) = ₹18.6 lakh

- New lot size (65 units) = ₹16.1 lakh

That’s a difference of more than ₹2 lakh in contract value!

So, your margin requirement may drop from ₹2.04 lakh to around ₹1.77 lakh — making trading lighter on your wallet.

What Should Traders Do Now?

- Stay alert between October–December 2025 — both old and new lot sizes will coexist.

- Always confirm the lot size before placing any order.

- Keep an eye on NSE circulars and broker updates to stay informed.

Small differences in lot size can lead to big differences in your exposure — so attention to detail matters.

Final Thoughts

This move by NSE is a positive step toward making trading more inclusive.

By reducing the lot sizes, NSE is encouraging more participation, especially from retail traders. This can also improve liquidity in the derivatives market — benefiting everyone involved.

Want to Move from Manual to Automated Trading?

Manual trading takes time, effort, and constant screen-watching. But what if your computer could trade for you — based on your own strategies?

That’s where we at TradeHull can help.

We specialize in helping traders automate their trading systems, so your strategies can run automatically — even when you’re not watching.

Here’s what we do:

- Build and test your custom trading strategies.

- Connect your system to live markets securely.

- Set up risk management rules to protect your capital.

- Offer ongoing support to keep your system running smoothly.

With automation, your trading becomes smarter, faster, and less stressful.

If You Want to learn more?

Visit our Contact Page and send us a message — let’s take your trading to the next level.