We often hear traders say:

“Volatility is too high, I’ll wait.🗣️

“Or worse…😬

“This market’s too quiet. Nothing to do.” 🛌

Truth is — volatility isn’t the enemy. It’s price movement, and movement is where the edge lives. If you understand it, you can anticipate risk, price your trades smarter, and stop reacting emotionally.

Whether you’re a scalper, options trader, or quant-in-the-making, mastering volatility is non-negotiable.

If you know how to read it, volatility tells you:

🧠 When to size up

📈 When premiums are overpriced

🚪 When to stay out

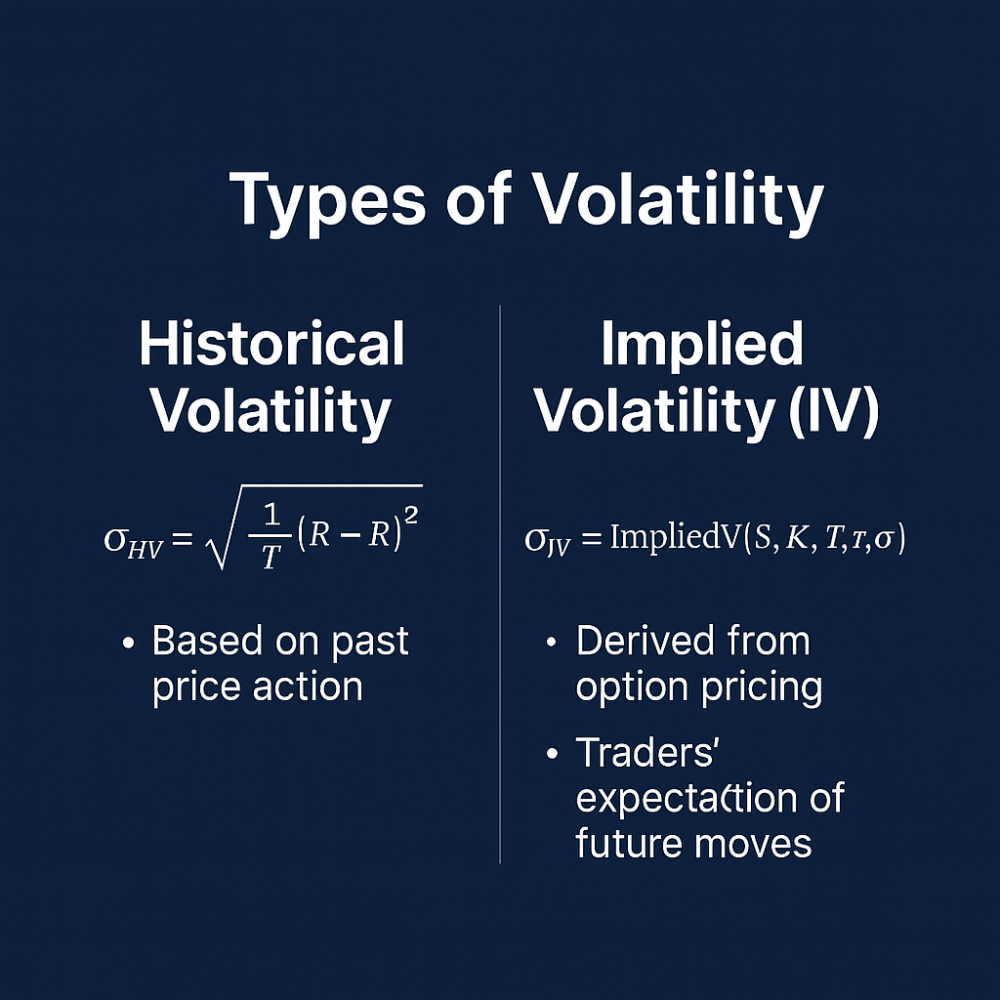

Historical vs Implied Volatility

Historical Volatality shows what past was 🕰️. Its like a rearview mirror.

Implied Volatality whispers what future might be 🔮. Its like a fear gauge.

# calculation for implied volatality

from scipy.optimize import brentq

from scipy.stats import norm

import math

# Black-Scholes Formula

def black_scholes_call(S, K, T, r, sigma):

d1 = (np.log(S/K) + (r + 0.5 * sigma**2)*T) / (sigma * np.sqrt(T))

d2 = d1 - sigma * np.sqrt(T)

return S * norm.cdf(d1) - K * np.exp(-r*T) * norm.cdf(d2)

# Implied Volatility Solver

def implied_volatility(C_market, S, K, T, r):

objective = lambda sigma: black_scholes_call(S, K, T, r, sigma) - C_market

return brentq(objective, 1e-6, 5)

# Example Inputs

S = 22500 # Spot Price

K = 22500 # Strike

T = 7 / 365 # Time to Expiry (7 days)

r = 0.065 # Risk-free rate (6.5%)

C_market = 150 # Option Premium (Call)

iv = implied_volatility(C_market, S, K, T, r)

print(f"Implied Volatility: {iv:.2%}")

Calculation for Historical Volatility

import pandas as pd

import numpy as np

import yfinance as yf

# Load data (e.g., NIFTY or any stock/index)

symbol = "^NSEI" # Nifty 50 Index (change as needed)

data = yf.download(symbol, period="6mo", interval="1d")

# Calculate log returns

data['log_ret'] = np.log(data['Close'] / data['Close'].shift(1))

# Historical Volatility (Annualized)

hv = data['log_ret'].std() * np.sqrt(252)

print(f"Historical Volatility: {hv:.2%}")

How to use it

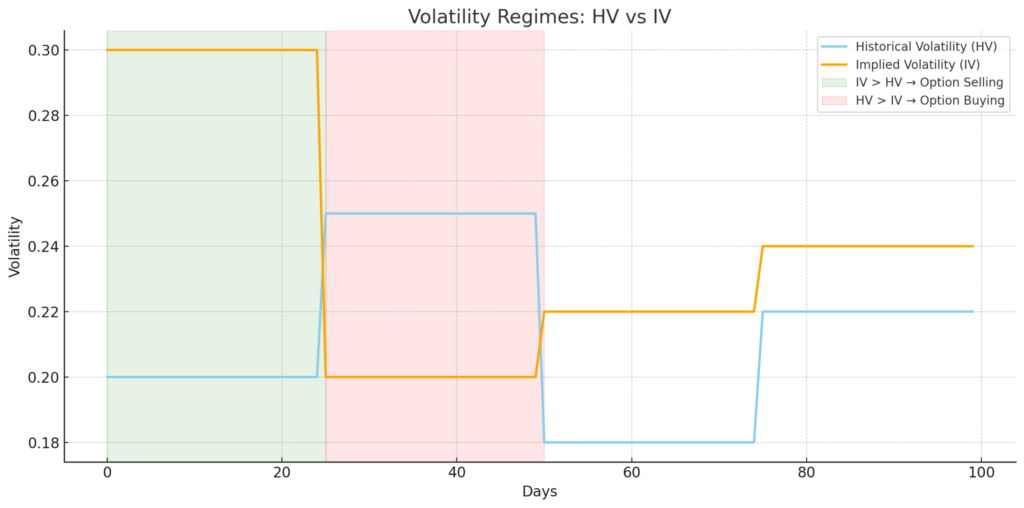

⚠️ When IV > HV → Options are expensive → Best time for Option Selling

💸 When HV > IV → Market may be underpricing real risk → Best time for Option Buying

Graphical Representation

For advance reading see:

Will Selden https://www.linkedin.com/pulse/volatility-risk-premium-amateurs-one-year-foray-capture-will-selden

Volatility Trading by Euan Sinclair

Explanation video by TradeHull : https://youtu.be/O0MP1v8zdLI?si=VbH48dJrgofwKrqX