There was a time when traders stood shoulder to shoulder on the stock exchange floor, shouting prices and waving slips of paper to grab attention. It was loud, chaotic, and full of energy — but that era is now history.

Today, trading has quietly moved from the shouting pits to powerful computers. And this modern, efficient way of trading is known as Algorithmic Trading, or simply Algo Trading.

If you’ve ever heard someone say, “Robots are trading stocks these days,” and wondered what that really means — here’s the truth: it’s not magic, it’s logic.

Algo trading is all about using computer programs to buy and sell stocks automatically, following a set of rules that you decide.

Think of it like setting up a super-smart assistant who never sleeps. You just tell it what to do — for example:

“When this stock reaches ₹500, buy 100 shares.”

Once you’ve defined the rule, the system does the rest. It constantly monitors the market, and the moment your condition is met, it executes the trade — instantly, without emotion or delay.

That’s the beauty of algorithmic trading — you don’t have to sit glued to the screen all day. Your algo watches, waits, and trades on your behalf, while you focus on other things.

You can even create advanced strategies using multiple factors like price, time, volume, or technical indicators — and your computer will follow them faster and more precisely than any human could.

In short, while you’re sleeping, working, or relaxing, your algorithm keeps scanning the market and executing trades on time, every time.

Manual Trading vs Algorithmic Trading

Before algos came into the picture, trading was a manual game.

Traders would spend hours watching charts, waiting for the right moment to click the “Buy” or “Sell” button. Every move depended on their attention, emotions, and instincts.

But let’s be honest — humans make mistakes. We get tired, distracted, or emotional, and that can lead to missed opportunities or impulsive trades.

Algorithmic trading removes that weakness.

Instead of relying on emotion or guesswork, you rely on logic. You set your trading plan once, and your computer follows it perfectly — no hesitation, no fear, and no greed.

It’s like upgrading from a manual car to an automatic one. You still decide the direction, but now the system handles the execution with precision.

Here’s a simple way to see the difference 👇

| Feature | Manual Trading | Algorithmic Trading |

|---|---|---|

| Who makes the trade | Human | Computer program |

| Speed | Slower | Very fast |

| Emotions | Affects decisions | No emotions at all |

| Accuracy | Depends on trader | Highly accurate |

| Data handling | Can analyze limited data | Can process large amounts instantly |

| Availability | Only when trader is active | 24/7 monitoring |

In short, manual trading depends on human judgment, while algo trading relies on logic, discipline, and lightning-fast execution. The computer doesn’t get tired, emotional, or distracted — it simply follows the rules you’ve set, trade after trade.

A Simple Real-Life Example

Let’s say you’re a trader who loves using moving averages — a common indicator that tracks the average price of a stock over time.

Your old manual method looked like this:

Wake up at 9:15 AM sharp

Open your trading app

Check if the 5-day moving average crosses above the 20-day moving average

Manually place a buy order

Keep watching the screen all day

Manually sell when the signal reverses

Sounds exhausting, right?

Now, here’s how it works with Algo Trading:

You set one simple rule: “Buy 100 shares when the 5-day MA crosses above the 20-day MA.”

Code it once (or use a no-code platform)

Sit back and relax

The algorithm monitors the market 24/7 and executes trades in milliseconds

You just get notifications when trades happen — no stress, no missed chances

That’s the real magic of algorithmic trading — you turn your strategy into a smart system that works for you, not the other way around.

How Do Algorithms Actually Make Buy/Sell Decisions?

Algorithms aren’t magic — they’re just really good at following instructions.

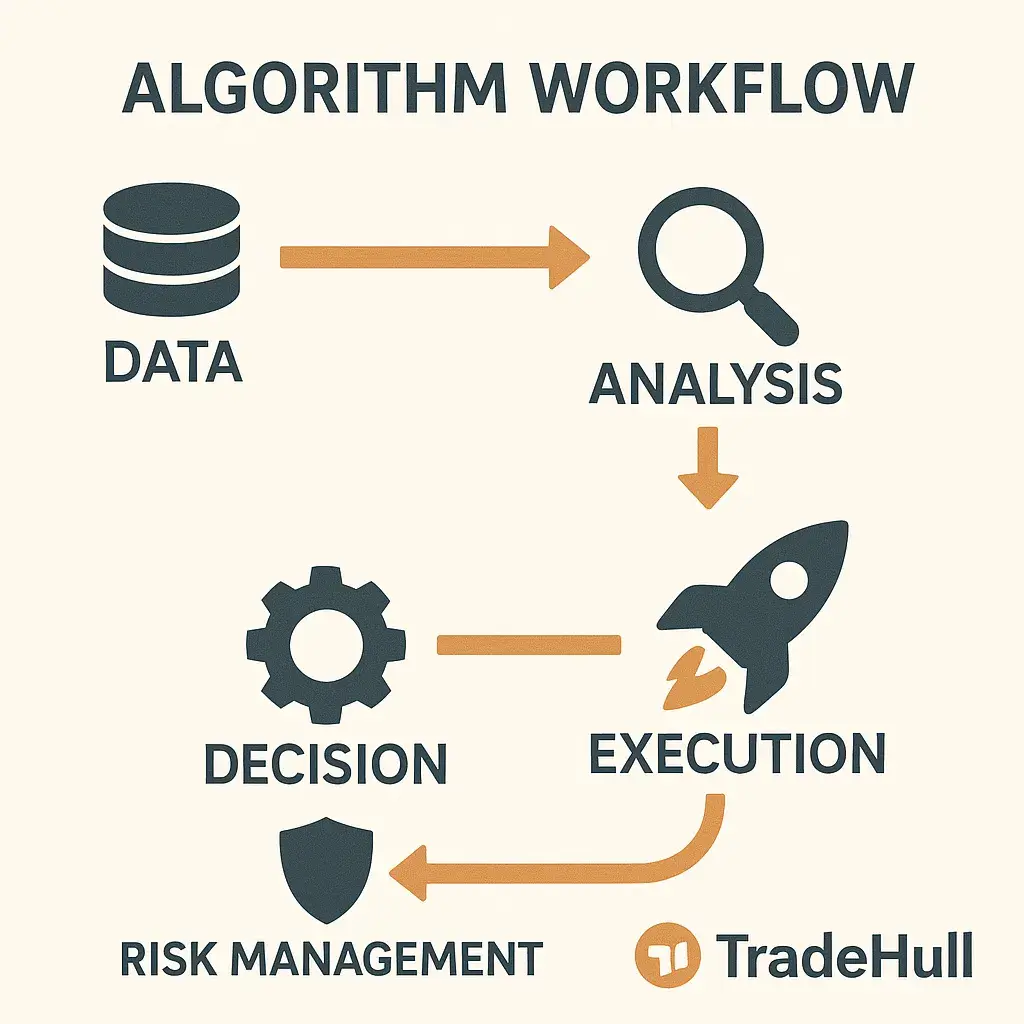

Behind every successful algo, there’s a series of smart steps happening quietly in the background. Let’s break it down:

1. Data Collection

Your algorithm constantly listens to the market — grabbing real-time data like stock prices, trading volumes, bid-ask spreads, and other key indicators. It’s like having a personal market analyst working 24/7.

2. Analysis

Next, it checks this data against the rules you’ve set. For example, it might ask:

“Is the RSI below 30?” (That usually signals the stock is oversold.)

“Has the price broken above the resistance level?”

“Is today’s trading volume unusually high?”

It’s your strategy, just automated and lightning-fast.

3. Decision Making

When all the right conditions align, the algorithm decides what to do — “Time to buy” or “Time to sell.” No hesitation, no emotions, just pure logic.

4. Execution

Once the decision is made, the algorithm instantly sends your order through your broker’s API to the exchange. The trade is executed in milliseconds — often faster than you can blink.

5. Risk Management

Smart algos don’t just trade; they also protect you. Features like stop-losses, position sizing, and max-loss limits make sure you never risk more than you’re comfortable with.

Example: Moving Average Crossover

Let’s simplify algo trading with one of the most common examples — the Moving Average Crossover strategy.

A moving average simply shows the average price of a stock over a certain number of days. Traders use it to identify trends — whether the market is moving up, down, or just sideways.

Here’s how the strategy works in an algorithmic setup:

Pick two moving averages — for instance, a 5-day and a 20-day moving average.

Set your rules:

Buy when the 5-day moving average crosses above the 20-day moving average (an uptrend).

Sell when the 5-day moving average crosses below the 20-day moving average (a downtrend).

Let the algorithm take over — it constantly monitors prices in real time.

Automatic execution — the moment the condition is met, your algo places the trade instantly — no waiting, no emotional hesitation.

Think of it this way:

When the short-term momentum (5-day) overtakes the long-term trend (20-day), it’s like the market saying, “Hey, things are heating up — time to buy.”

When it slips back under, it’s a sign to “cool off” and exit.

This is just one of the simplest examples of how algo trading works.

Once you understand this logic, you can build much more powerful strategies — combining price action, volume, volatility, or even AI-driven models — and let your system handle all the hard work for you.

The Honest Truth: Benefits and Risks of Algo Trading

Like every powerful tool, algorithmic trading comes with its share of pros and cons.

Let’s be real for a second — it’s not some “get-rich-quick” magic button, but it can give you a serious edge if used wisely.

The Good Stuff (Why Traders Love It)

Speed: Your algorithm can execute trades in microseconds — faster than any human could ever click a mouse.

Discipline: No emotions, no panic selling, no FOMO — just pure logic following your pre-set rules.

Consistency: The same strategy, executed the same way, every single time. No mood swings, no “gut feelings.”

Efficiency: You can run multiple strategies and track multiple stocks at once — something impossible manually.

Time-saving: No need to stare at charts all day; your code does the heavy lifting while you focus on other things.

Backtesting: Before risking a single rupee, you can test your ideas on historical data to see if they actually work.

The Challenges (What You Should Watch Out For)

Technical complexity: You’ll need at least basic coding knowledge or support from a developer.

System failures: Power cuts, poor internet, or hardware issues can ruin trades — especially during volatile markets.

Setup costs: Reliable data feeds, VPS servers, or paid APIs often come with a price tag.

Lack of flexibility: Algorithms can’t “think” when sudden market news or political events shake things up.

Overfitting risk: A strategy that performs great in backtesting might fail miserably in live trading.

Regulatory compliance: You must follow SEBI’s algo trading regulations if you’re trading in India.

Not a money machine: Even with perfect coding, profits are never guaranteed. Algo trading reduces human errors, not trading risks.

Algorithmic trading isn’t a magic money machine, nor is it something impossibly complex. It’s simply a tool — and like any tool, its power depends entirely on how you use it.

If you’re willing to learn, test, and refine your strategies, algo trading can become a game-changer in your trading journey. It won’t erase risk completely, but it will help you trade with more discipline, structure, and efficiency.

Remember:

- Start small.

- Keep learning.

- And never risk more than you can afford to lose.

The markets aren’t going anywhere — they’ll always be there tomorrow.

Have Questions? Let’s Talk!

Whether you’re just beginning your algo trading journey or looking to level up your systems, I’m here to guide you through it.

- Reach out today: https://tradehull.com/contact/

Don’t hesitate to connect if you’re stuck, curious, or just want to exchange ideas about trading strategies.

We’re all learning, experimenting, and growing — together.